How to Test for Radon in NEPA: DIY vs. Professional Testing

Radon is one of the most overlooked health risks in residential homes, yet it’s also one of the most dangerous. You can’t see it, smell it, or taste it, but prolonged exposure is the second leading cause of lung cancer in the United States.

An estimated 40% of homes across Pennsylvania have radon levels above the EPA’s recommended action guideline of 4 picocuries per liter (pCi/L).

Professional radon testing provides the most accurate analysis of radon exposure across different levels of the home, where radon tends to be most concentrated on lower levels.

However, DIY and store-bought radon kits are available, but their results can vary and yield inaccurate estimates.

This guide walks through how radon testing works, when DIY testing is sufficient, when professional testing makes more sense, and how to decide which approach fits your situation.

What Is Radon and Why Testing Matters

Radon is a naturally occurring radioactive gas that forms when uranium decays in soil and rock. It moves upward through the ground and can enter homes through cracks in foundations, sump pits, crawl spaces, floor drains, and construction joints.

Once inside, radon can accumulate to dangerous levels, especially in lower areas like basements and crawl spaces. Because radon exposure happens over time, homeowners often don’t realize there’s a problem until elevated levels are discovered through testing.

Testing is the only way to know if radon is present in your home at unsafe levels. The Environmental Protection Agency (EPA) recommends action if radon levels are 4.0 picocuries per liter (pCi/L) or higher, though even lower levels carry some risk.

How Common Is Radon in Northeast Pennsylvania?

Radon is very common in Northeast Pennsylvania due to regional geology. Areas with shale, granite, and uranium-rich rock formations naturally produce higher levels of radon gas. Combine that with older housing stock, basements, and fluctuating seasonal pressure changes, and many homes unknowingly trap radon indoors.

What makes radon particularly challenging is that elevated levels can vary dramatically from house to house—even on the same street. Two neighboring homes built at the same time can test very differently based on foundation type, soil composition, and ventilation patterns.

Because radon levels are so location-specific, regional averages don’t provide protection. Individual testing is the only reliable way to assess risk in your specific home.

How Radon Testing Works

Radon testing measures the concentration of radon gas in indoor air over a defined period of time. Tests fall into two broad categories:

- Short-term tests (2–7 days)

- Long-term tests (90 days to 12 months)

Short-term tests are commonly used for real estate transactions or initial screening. Long-term tests provide a more accurate picture of average exposure over time, accounting for seasonal changes.

Both DIY kits and professional services use these same testing principles, but the difference lies in how the test is deployed, monitored, and interpreted.

How Accurate Is DIY Radon Testing?

DIY radon testing can be accurate when done correctly, but results are highly sensitive to placement and testing conditions. Most DIY kits use charcoal canisters, alpha track detectors, or consumer-grade digital monitors. These devices absorb or detect radon over time and either display a reading or require lab analysis.

Accuracy depends on following instructions precisely. Tests must be placed in the lowest livable level of the home, away from drafts, windows, exterior walls, and high-humidity areas.

The challenge is that small mistakes can skew results. A test placed too close to a sump pit, HVAC vent, or exterior wall may over- or under-report levels.

DIY tests also can’t detect whether environmental conditions changed during testing, such as a window being opened or a pressure shift caused by weather.

DIY testing works best as a screening tool, but nothing more. It can tell you whether radon is likely present and whether further testing is needed.

DIY vs. Professional Radon Testing: Key Differences

The following table discusses the pros and cons of professional radon testing vs. DIY kits.

| Factor | DIY Testing | Professional Testing |

| Cost | Lower | Higher |

| Accuracy | Variable | High |

| Ease | Simple | Hands-off |

| Interpretation | Homeowner responsibility | Expert guidance |

| Real estate use | Often not accepted | Widely accepted |

| Monitoring | Limited | Continuous & verified |

Professional testing is always recommended when there is any suspicion of radon present on the property or a real estate transaction is made to guarantee accurate results.

When to Invest in Professional Radon Testing?

Professional testing is commonly recommended for many scenarios where proper evaluation and documentation are essential:

- Buying or selling a home

- Finishing a basement or changing HVAC systems

- DIY results are near or above 4.0 pCi/L

- Long-term health exposure is a concern

- Documentation is required for lenders or negotiations

Instead of leaving interpretation to the homeowner, professional testing provides clear next steps if mitigation is needed.

What to Do If Radon Levels Are High

If testing shows radon levels at or above 4.0 pCi/L, mitigation is recommended. Radon mitigation systems typically involve sub-slab depressurization, which redirects radon gas safely outside before it enters the home.

Even if levels are between 2.0 and 4.0 pCi/L, many homeowners choose mitigation as a preventative measure, especially in homes with finished basements or long-term occupancy.

Choosing the Right Testing Approach

DIY radon testing is a good starting point for homeowners who want basic awareness and are comfortable following instructions carefully, but it should never be relied on as a true diagnostic tool. Professional testing is the better option when accuracy, documentation, or expert interpretation matters, especially since radon levels are significantly elevated in Northeast PA.

The last thing any future homeowner wants is to purchase a home with elevated radon for years without knowing of the exposure. Invest in professional radon testing to protect your health and gain peace of mind.

FAQs: How to Test for Radon

How long does a radon test take?

Short-term tests take 2–7 days. Professional tests typically run for 48 hours. Long-term tests may last several months.

Can I test for radon myself and trust the results?

Yes, if the test is placed correctly and instructions are followed. However, borderline or high results should be confirmed with additional or professional testing.

Is professional radon testing worth the cost?

Professional testing provides higher accuracy, tamper detection, and expert interpretation, which is especially important for real estate transactions or health-related concerns.

Where should a radon test be placed?

Tests should be placed in the lowest livable level of the home, away from drafts, windows, exterior walls, and high-humidity areas.

Do new homes need radon testing?

Yes. New construction can still have elevated radon levels depending on soil conditions and building design.

Can weather affect radon test results?

Yes. Heavy rain, snow cover, and seasonal pressure changes can influence radon levels, which is why long-term or repeated testing is often recommended.

What radon level is considered dangerous?

The EPA recommends mitigation at 4.0 pCi/L or higher, though no level is completely risk-free.

If my neighbor has high radon, will I too?

Not necessarily. Radon levels can vary significantly between nearby homes due to soil, foundation type, and ventilation.

Do I Really Need a Home Inspection in NEPA?

Buying or owning a home in Northeast Pennsylvania comes with challenges that aren’t always obvious at first glance. Many properties in NEPA are older, built on varied terrain, and exposed to decades of weather, freeze–thaw cycles, and moisture intrusion.

It can be easy to overlook these issues in exchange for a more affordable home in your price range, but that cost will be reclaimed somewhere along the line.

Getting a home inspection is essential for diagnosing costly issues that could impact your safety and wallet, and it’s also a helpful tool for getting pricing that reflects the home’s actual condition.

We’ve had several homeowners come to us after purchasing a house and discovering an issue that wasn’t disclosed to them, to uncover what else might be waiting for them.

Don’t skip a home inspection on your next real estate purchase in NEPA. Learn more about why home inspections are essential and why every party–buyers, sellers, and owners–should get one.

What Is and Is Not Included In a Home Inspection?

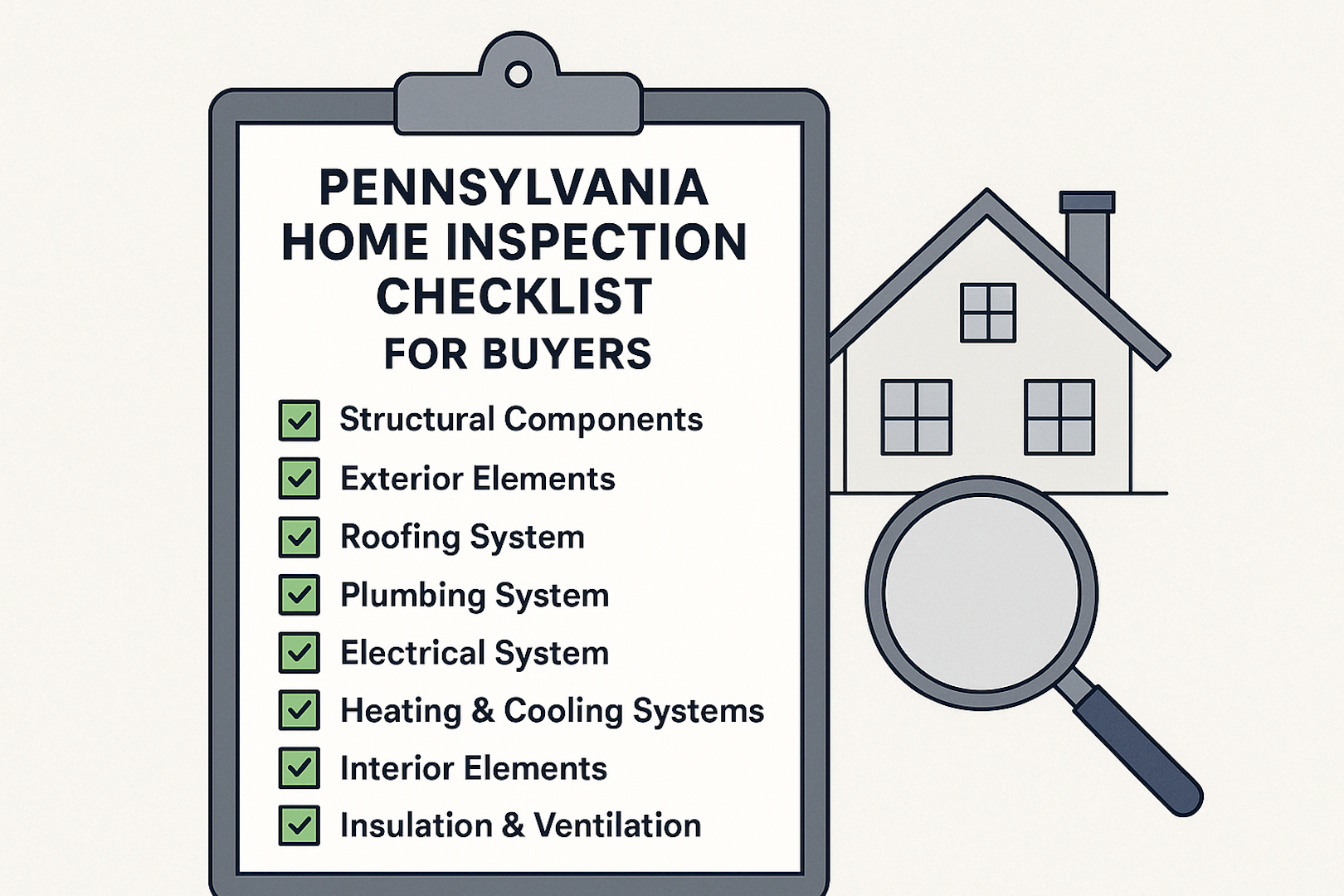

A home inspection is a comprehensive evaluation of a property’s major systems and structural components. The inspector’s role is to identify visible defects, safety concerns, and signs of deterioration, but they cannot guarantee perfection or predict future failures.

A standard home inspection typically includes an evaluation and description of the following components:

- Roof and exterior surfaces

- Foundation and structural components

- Basement or crawl space conditions

- Electrical, plumbing, and HVAC systems

- Attic insulation and ventilation

- Windows, doors, and interior finishes

Inspectors use advanced tools, including thermal moisture meters, roof drones, and other diagnostic tools, to assess critical components of the home.

However, home inspections can only go so far in uncovering common issues and typically address only major structural components.

Water and air quality, radon, septic systems, and termite damage often require specialized tools and inspection processes to assess their condition.

Why Home Inspections Matter in NEPA

Home inspections are important for any property, regardless of its location, age, or condition.

However, homes in Northeast Pennsylvania face local environmental conditions that make inspections especially valuable. Many properties were built decades ago, often before modern waterproofing, insulation, or drainage standards were common, leaving them susceptible to erosion, poor ventilation, and age-related distress.

Several homes throughout the valley and the Poconos still have outdated knob-and-tube wiring, inefficient energy systems, and DIY modifications that don’t meet modern safety standards.

Benefits of a Home Inspection for Buyers and Sellers

A professional home inspection reduces risk for everyone involved in a real estate transaction and helps price the property more accurately.

Home inspections aren’t just used exclusively by buyers; they help at every stage of the home transaction process.

For buyers, a home inspection helps by:

- Revealing the true condition of the home. Inspections go beyond cosmetic finishes to evaluate structure, roofing, electrical, plumbing, HVAC, drainage, and safety systems.

- Clarifying future costs. Understanding what needs attention now versus later helps buyers budget realistically and avoid unexpected repair expenses.

- Reducing emotional decision-making. Objective findings replace guesswork, allowing buyers to make informed choices rather than relying on appearances.

- Supporting negotiation leverage. Verified inspection findings can justify repair requests or price adjustments without speculation.

For sellers, a home inspection provides value by:

- Minimizing last-minute surprises. Identifying issues early prevents deal disruptions late in the transaction.

- Allowing proactive repairs or disclosures. Sellers retain control over how issues are addressed rather than reacting under time pressure.

- Improving buyer confidence. Transparency builds trust and reduces hesitation, especially with out-of-area or first-time buyers.

- Helping transactions close faster. Fewer unknowns typically lead to smoother negotiations and fewer delays.

When Is a Home Inspection Recommended?

In Northeast Pennsylvania, inspections are recommended any time a property is changing hands or undergoing a major decision that affects safety, value, or long-term ownership.

We strongly recommend a home inspection for any of the following circumstances to get an unbiased view of its condition, value, and any pertinent safety concerns:

- Buying a home. Inspections uncover hidden defects that aren’t visible during showings, especially in basements, attics, and mechanical systems common in NEPA homes.

- Selling a home. Pre-listing inspections help sellers identify issues early, avoid renegotiations, and price the home accurately.

- Purchasing an older property. Many homes in NEPA were built decades ago and may include outdated wiring, aging foundations, or legacy drainage systems.

- Buying without recent inspection history. Even well-maintained homes can have deferred maintenance that isn’t obvious without a formal evaluation.

- Finishing a basement or remodeling. Inspections can identify moisture, ventilation, or structural issues that should be addressed before investing further.

- After major weather events. Heavy rain, flooding, or freeze-thaw cycles can create problems that weren’t previously present.

- Buying from out of the area. Remote buyers often rely on inspections to understand local construction standards, soil conditions, and environmental risks.

In many instances, a home inspection can be used to identify or rule out major repairs when working with a contractor.

Next Steps After a Home Inspection

A home inspection report provides a roadmap that helps buyers and sellers decide how to move forward with clarity.

After receiving a home inspection, the typical next steps include:

- Reviewing the report carefully. Focus on safety issues, structural concerns, water intrusion, electrical problems, and major mechanical systems rather than minor cosmetic items.

- Prioritizing findings. Not every issue requires immediate action. Understanding what affects safety, longevity, or resale value helps guide decisions.

- Consulting specialists if needed. Inspectors identify concerns but may recommend licensed professionals for further evaluation or repair estimates.

- Negotiating repairs or credits. Buyers may request repairs, price adjustments, or closing credits based on verified inspection findings.

- Planning future maintenance. Even if no negotiations occur, inspection results help homeowners plan upgrades and preventive maintenance.

- Deciding whether to proceed. In rare cases, inspections reveal issues significant enough to reconsider the purchase altogether.

For sellers, inspection findings often guide strategic repairs or disclosures that prevent delays and keep transactions on track.

A home inspection may seem like an added cost, but the return on investment can be massive, depending on the extent of future repairs and improvements needed to the property you’re buying, selling, or maintaining.

FAQs

Do I legally need a home inspection in Pennsylvania?

No. Home inspections are not legally required, but they are strongly recommended to protect buyers and homeowners from unknown defects.

How long does a home inspection take?

Most inspections take 2–4 hours, depending on the size, age, and condition of the home.

Will a home inspection find basement water problems?

Yes. Inspectors look for moisture stains, efflorescence, grading issues, and foundation cracks that suggest current or past water intrusion.

Can a home inspection replace a structural engineer?

No. Inspectors identify concerns, but structural engineers are needed for detailed analysis of major structural issues.

Are inspections different for older homes?

Yes. Older homes often require closer attention to foundations, electrical systems, plumbing materials, and insulation.

Should I get an inspection on a newly built home?

Yes. New homes can still have construction defects, grading issues, or drainage problems that only appear after occupancy.

Do inspectors test for radon or mold automatically?

Not usually. Radon, mold, and pest inspections are typically separate services unless specifically requested.

Is a home inspection worth it if I’m buying “as-is”?

Absolutely. An inspection helps you understand what “as-is” really means before you commit.

How Does Termite Damage Impact Your Resale Value in NEPA?

Selling a home with termite damage in NEPA can lower your resale value by as much as 20%.

Termites often infest homes silently for many years before homeowners discover and treat them. These wood-destroying organisms are attracted to moisture and soft woods, often attacking crucial framing members of your home and exposed wooden furniture.

Termites cause more than $5 billion in property damage every year in the United States, making them a significant threat to residential properties in Pennsylvania with wooden frames.

Even if termites are treated, and past damage exists, it can still lower your resale value and impact insurance coverage. Any termite damage must be disclosed on the seller’s disclosure, making it illegal to cover up past damage.

If you’re buying or selling a home in Northeast Pennsylvania and are curious about how much past termite damage can affect the value of your property, this guide will walk through different scenarios to provide a rough estimate of how much it will lower.

How Much Damage Can Termites Cause to Homes?

Over a few-month period, a single colony of 60,000 termites can chew through an entire 2×4 plank of wood.

In Pennsylvania, where subterranean termites are the most common termite–and also the most destructive–the average colony can consist of anywhere from 60,000 termites to over one million.

The primary issue is that termites can often exist for months, if not years, before being discovered. All it takes is one severely weakened floor joist, loading bearing beam, or wall stud to cause structural issues that ripple throughout your entire home’s structure.

According to Angi, nationwide estimates for termite repair costs range from $1,000 to over $10,000.

How Termite Damage Affects Your Home’s Resale Value

The financial impact of termites varies widely, depending on factors such as severity, location, and whether repairs were completed. Below are the biggest ways termite damage influences home value.

1. Lower Appraisal Value

Home appraisers look at overall condition, market comparables, and structural integrity. Confirmed termite damage—even if repaired—can reduce appraised value because:

- Structural components have been compromised

- The home may be considered a higher-risk investment

- Repairs may not restore the original value if the structural timber was replaced

- Local comps without termite history will be valued higher

Even minor termite damage can lower the value by several percentage points. Severe, unrepaired damage can reduce the home’s value significantly more.

2. Reduced Buyer Confidence

Buyers are cautious, especially when it comes to homes older than 50 years in NEPA. Termite damage raises immediate concerns, such as:

- “What else is hiding behind the walls?”

- “Was the damage fully repaired, or just patched?”

- “Will termites return?”

While some buyers are willing to negotiate for lower rates, many buyers will walk away entirely.

3. Required Repair Credits or Price Reductions

When termite damage appears on an inspection report, buyers commonly request seller concessions, such as repair credits, treatment guarantees, reinspections, or a lower sale price. Depending on the extent of damage, these reductions can range from minor adjustments to substantial price drops.

4. Mandatory Treatment & Repairs Before Closing

Mortgage lenders, especially FHA, VA, and USDA loans, require homes to be free of wood-destroying insects.

If termites are found, sellers are typically required to:

- Pay for a full treatment

- Repair or replace all damaged components

- Provide documentation of clearance

Failure to do so can delay or disqualify financing.

How Common Is Termite Damage in NEPA?

While termites are more common in the south, they are still very common in Northeast Pennsylvania–particularly older homes with moisture issues and homes surrounded by trees.

Typical hotspots where termite inspectors look around your home include:

- Sill plates

- Support beams

- Rim joists

- Basement perimeter walls

- Deck posts

- Garages

- Additions with old framing

Because termite activity can remain hidden for years, most homeowners don’t discover the problem until they prepare to sell.

The Importance of Wood-Destroying Organisms (WDOs) Inspections

A standard home inspection will note visible damage, but often doesn’t include or seek out damage from a wood-destroying organism (WDO). In addition to termites, several pests can cause widespread wood damage, including carpenter ants and wood-boring beetles.

In Pennsylvania, buyers using FHA, VA, or USDA loans often need a WDO inspection for mortgage approval.

A clean WDO report is a significant selling advantage, especially if done with a pre-listing inspection. A report showing damage or activity must be addressed before the deal can move forward.

What Happens If Termite Damage Is Found on the Inspection Report?

Termite damage rarely kills a deal outright, but it does shift negotiations and responsibilities for both the seller and the buyer. Once damage is identified, both sides must decide how to move forward based on the extent of the issue and what the contract allows.

Sellers generally have three choices:

- Make repairs before closing — Treat active termites, fix structural components, and provide documentation. Helps preserve the home’s value but requires upfront cost and potential delays.

- Offer a repair credit — Provide a financial concession instead of completing repairs. Keeps the deal moving but reduces the seller’s net proceeds.

- Sell the home as-is — Often chosen for older or inherited properties. Avoids repair obligations but typically results in lower offers and a smaller buyer pool.

Buyers also have several options once termite activity or structural damage is confirmed:

- Request full treatment and repair from the seller

- Negotiate a lower purchase price

- Ask for a transferable termite warranty

- Walk away if their inspection contingency allows it

A qualified home inspector can help both parties understand whether the damage is minor, moderate, or structurally significant, ensuring buyers make informed decisions and sellers know what to expect during negotiations.

FAQs

Can a home fail inspection because of termite damage in NEPA?

Severe structural damage or active infestations can stop a sale until treatment and repairs are completed.

Do sellers in PA have to disclose termite damage?

Yes. Pennsylvania requires disclosure of known infestations, treatments, and structural damage on the Seller’s Property Disclosure Form.

Will buyers still make offers on a home with termite history?

Absolutely—if the issue was treated and repaired. Documentation is key.

Does homeowner’s insurance cover termite damage?

No. Termite damage is considered preventable maintenance and is not covered under standard policies.

How long after treatment can I sell my home?

Immediately, provided you have a clearance letter, and there is no active infestation.

Do termite warranties transfer to the new owner?

Many do. Transferable warranties increase buyer confidence and can improve resale value.

7 Signs of Home Mold Exposure: Do You Need an Inspection?

Mold is present in every home in Northeast Pennsylvania, but the type and extent of mold exposure can vary. According to Ruby Homes, 47% of homes across the US have visible signs of mold.

Despite its prevalence, many homeowners don’t notice a mold problem until physical symptoms begin appearing.

Mold often develops behind walls, inside basements, or within HVAC systems, making it difficult to detect. Older homes in Scranton and Wilkes-Barre with drainage issues and poor ventilation are more susceptible to mold and should be inspected when purchasing a new home.

Traditional home inspections may miss mold exposure, especially behind visible surfaces.

If you’ve experienced recurring respiratory irritation, musty odors, or strange discoloration on walls, it may be time to get a specialized mold inspection.

This guide explains how mold forms, the most common signs of exposure, where mold hides in homes across NEPA, and when you should schedule a certified mold inspection.

What Causes Mold to Grow in a Home?

Mold spores are always present, but they become a problem when indoor conditions support growth. Mold needs only three things: moisture (leaks, humidity, condensation), organic material (wood, drywall, carpet, insulation), and dark, poorly ventilated spaces.

Homes in Scranton, Wilkes-Barre, and the Poconos are especially prone to mold due to older construction, high humidity, basement dampness, and seasonal freeze-thaw cycles that cause roof and foundation leaks.

Once mold takes hold, colonies spread quickly, and spores can become airborne, leading to noticeable signs of exposure.

The Most Common Signs of Mold Exposure

Mold exposure affects people differently, but there are several shared signs that could point to persistent mold exposure.

1. Persistent Musty Odors

A musty, earthy smell is the most recognizable sign of mold, even when no visible colony is present.

These odors often come from:

- Damp basements

- Crawl spaces

- Behind drywall

- Under carpets

- Inside HVAC ducts

If your home smells musty after rain, after running the AC, or when entering from outside, you may have hidden mold growth.

2. Allergy-Like Symptoms That Improve When You Leave Home

One of the strongest indicators of mold exposure is when allergy symptoms vanish once you leave the house.

Common signs include sneezing, congestion, throat irritation, and sinus pressure.

If these symptoms appear mainly at home, but not at work, outdoors, or on vacation, that’s a strong sign that mold may be present indoors.

3. Visible Mold Growth

Early mold growth is often subtle, which is why homeowners frequently overlook it. It may appear as small black specks, pale yellow or green smudges, white fuzzy film, or even orange staining around sinks and drains.

Any visible mold—no matter how small—signals active growth and a larger moisture problem nearby. In most cases, a small patch on the surface means a much more extensive colony may be spreading behind walls, under flooring, or inside HVAC systems.

4. Recurring Flu-Like Symptoms

Some homeowners begin experiencing cold-like symptoms that never fully go away, including fatigue, headaches, sinus irritation, or a lingering “under the weather” feeling.

These symptoms often worsen after showers, rainy days, or in rooms with higher humidity. Because mold releases airborne spores that fluctuate with moisture levels, symptoms tend to come and go in cycles, making them easy to dismiss as seasonal illness.

5. Worsening Asthma or Breathing Problems

Individuals with asthma, COPD, or general respiratory sensitivities are among the first to feel the effects of mold exposure. They may notice tightness in the chest, persistent wheezing, shortness of breath, or increased reliance on inhalers.

These issues are often most noticeable in bathrooms, basements, laundry areas, and utility rooms—spaces where moisture and poor ventilation create ideal mold conditions.

6. Skin Irritation or Rashes

Certain types of mold release compounds that can irritate the skin, causing redness, itching, dryness, or unexplained rashes. Homeowners sometimes notice these symptoms intensify when they spend time near mold-prone areas such as damp basements, musty closets, or HVAC vents.

Symptoms typically ease after leaving the affected space, which is a strong indicator that mold may be the culprit.

7. Household Signs That Suggest Mold Growth

Peeling paint, warped drywall, and sagging or soft flooring typically signal ongoing moisture issues.

Brown or yellow water stains, persistent condensation on windows, and repeated plumbing or roof leaks also create ideal mold conditions.

Even efflorescence—a chalky white residue on basement walls—can indicate moisture movement through masonry, making mold growth extremely likely behind surfaces.

Where Mold Commonly Grows in NEPA Homes

Because of the region’s older housing stock, high humidity, and frequent freeze–thaw cycles, mold tends to appear in predictable areas throughout Scranton, Wilkes-Barre, Hazleton, and the surrounding counties. The most common hotspots include:

- Basements and crawl spaces with humidity, seepage, or poor drainage

- Bathrooms with steam buildup, hidden leaks, or inadequate ventilation

- Kitchens with plumbing failures, dishwasher leaks, or cabinet condensation

- Attics with roof leaks, wet insulation, or ventilation issues

- HVAC systems with condensation, dirty coils, or poor filtration

If mold develops in any of these areas, spores can easily circulate throughout the home.

When Should You Get a Home Mold Inspection?

A mold inspection is recommended any time you notice musty odors, see visible growth, experience recent water damage, or develop symptoms that improve when you leave the home.

Inspections are also crucial before buying or selling a property, since hidden mold can disrupt negotiations or lead to costly repairs. Homeowners planning renovations should also schedule an inspection so they don’t accidentally disturb hidden mold inside walls or flooring.

You should schedule a mold inspection if you experience:

- Persistent musty smells

- Visible mold patches, even small ones

- Any type of water damage (leaks, floods, roof failures)

- Real estate transactions where mold could impact value

- Health symptoms that disappear when away from home

- Renovation projects that may disturb concealed moisture areas

A certified mold inspector can locate the source, identify severity, and determine whether professional remediation is necessary—far more accurately than DIY test kits.

What a Professional Mold Inspection Includes

A qualified inspector examines the entire home (not just the visible mold) to pinpoint moisture sources, assess hidden areas, and evaluate air quality.

A complete inspection typically includes moisture mapping with thermal imaging, a full visual assessment of attics, basements, crawlspaces, and HVAC systems, optional air or surface sampling, and a detailed report outlining findings and recommended next steps.

How to Prevent Mold in Your Home

Long-term mold prevention begins with one core principle: controlling moisture before it becomes a problem. Homeowners in NEPA can greatly reduce mold risk by taking a few proactive steps:

- Keep indoor humidity below 50% year-round.

- Run exhaust fans in bathrooms and kitchens during and after use.

- Fix plumbing leaks immediately, especially around sinks, toilets, and appliances.

- Improve ventilation in basements and crawlspaces to limit trapped moisture.

- Insulate cold surfaces like pipes and exterior walls to reduce condensation.

- Clean and maintain gutters to prevent water intrusion near the foundation.

- Seal foundation cracks to stop groundwater seepage.

- Use a dehumidifier in damp areas—especially basements common in NEPA homes.

Mold can take hold quickly, but with consistent moisture control and good home maintenance habits, most mold problems can be prevented entirely. Staying ahead of leaks, humidity, and poor ventilation keeps your home healthier, safer, and free of recurring mold issues.

If you suspect mold in your home, don’t wait to schedule an inspection. We also recommend a separate mold inspection when purchasing a home, as mold rarely shows up on traditional reports unless it is visibly present on surfaces in the home.

FAQs

How do I know if my symptoms are caused by mold?

If symptoms worsen at home and improve when you leave, mold could be the cause. An inspection can confirm hidden growth.

Can mold make you sick even if you can’t see it?

Yes, hidden mold behind walls, carpets, and HVAC systems can release spores into the air.

Should I remove the mold myself?

Small surface patches can be cleaned, but large or hidden mold requires professional remediation.

Is mold inspection required during home buying?

Not always, but it’s highly recommended, especially for older homes or properties with visible water issues.

Do DIY mold test kits work?

They often give inaccurate results and cannot find hidden moisture or structural mold sources.

How quickly does mold grow after water damage?

Mold can begin growing in as little as 24–48 hours under the right conditions.

Is basement mold common in Scranton & Wilkes-Barre?

Yes. Aging foundations, poor drainage, and high humidity make mold extremely common in NEPA basements.

What Homes in NEPA Are Most At Risk for Radon?

Northeast Pennsylvania has one of the highest radon levels in the nation due to its unique geology and mineral history.

Approximately 40% of homes across the commonwealth have radon levels above the EPA-recommended level (4 pCi/L), with many older homes with poor ventilation or located on low elevations being most at risk.

Radon is a radioactive gas that forms naturally from the breakdown of uranium in soil and rock. The long-term effects of radon exposure include the risk of lung cancer, the second leading cause in the nation.

Radon testing is essential to protecting your family from harmful radon exposure and understanding your risks, as radon levels can fluctuate over time.

The region’s geology, combined with common home construction styles, makes many properties highly vulnerable to radon buildup. This guide explains which homes face the highest risk, why NEPA radon levels run unusually high, and what steps homeowners can take to stay safe.

Why Are Radon Levels High in Northeast Pennsylvania?

Radon is linked to Pennsylvania’s geology. When uranium-rich rock breaks down, radon gas escapes upward through soil and into buildings. NEPA has several environmental factors that make radon more common and more dangerous than in other parts of the country:

1. NEPA’s Geology Is Naturally Uranium-Rich

Counties like Luzerne, Lackawanna, Schuylkill, Wyoming, Carbon, and Monroe sit on rock formations with higher concentrations of uranium, such as the Mauch Chunk formation near Wilkes-Barre and extending down into Jim Thorpe. As uranium decays, radon levels rise, especially in lower-elevation parts of the home.

2. Valley Geography Creates Trapped Gas Zones

The Wyoming Valley, Lehigh Gorge, and surrounding Appalachian ridges create pockets where radon can accumulate underground before entering homes.

3. Historic Mining Disturbed the Soil

Decades of anthracite coal mining fractured rock layers and changed how soil gases move. Old mine shafts and voids can act as pathways that funnel radon directly toward foundations.

4. Pennsylvania Winters Increase Exposure

Cold weather keeps homes tightly sealed, preventing radon from escaping. Heating systems also create a “stack effect,” which pulls soil gas upward into the home.

These environmental factors combine to create a perfect storm for radon accumulation in NEPA. The only way to know your home’s level is to test it.

Which NEPA Homes Are Most at Risk for Radon?

While any home can have high radon, certain property types are more vulnerable across Northeastern Pennsylvania.

1. Older Homes Built Before Modern Ventilation Standards

Older homes across Scranton, Wilkes-Barre, Hazleton, Kingston, and Pittston often lack the tight building envelopes and controlled ventilation systems found in newer construction. For example, many of these homes contain outdated building practices that may make them susceptible to radon, including:

- Dirt-floor crawl spaces

- Fieldstone foundations

- Poorly sealed sump pits or floor drains

- Natural settling and foundation cracks

These structural gaps allow radon to move freely from the soil into the living space. Even minor foundation shifts over decades can dramatically increase radon entry.

2. Homes With Basements or Crawl Spaces

Radon moves upward from the soil and slips into your home through cracks in concrete, gaps around pipes, sump pits, expansion joints, and openings in block walls.

Crawl space homes are just as vulnerable because exposed soil continually releases radon, allowing the gas to rise into the living space above.

Virtually any home with direct soil contact offers more pathways for radon to enter, making basements and crawl spaces some of the highest-risk structures in NEPA.

3. Homes Built on Coal Fields or Near Abandoned Mines

Much of Luzerne and Lackawanna County sits on former anthracite mining land. These underground voids act like natural air channels.

Neighborhoods at higher risk from radon from old mining shafts include:

- Ashley

- Hanover Township

- Nanticoke

- Sugar Notch

- Parsons

- Miners Mills

- Throop and Olyphant

4. New Construction in NEPA

Surprisingly, new homes often have higher radon levels than older ones. Many NEPA homeowners assume a new build is safe, yet the opposite is often true.

Newer homes are built tightly for energy efficiency. This increases negative pressure indoors, which literally pulls radon out of the soil more aggressively.

5. Homes Built in Valleys, Low-Lying Areas, or High-Radon Zones

Homes located in low elevation pockets—like those throughout the Wyoming Valley—are more prone to radon accumulation because soil gases naturally settle and migrate downward.

NEPA ZIP codes with consistently elevated radon results include:

- 18702, 18704, 18705 (Wilkes-Barre area)

- 18508, 18509, 18510 (Scranton area)

- 18201, 18202 (Hazleton)

- 18301–18360 (Poconos)

Even if homes are miles apart, radon levels can dramatically vary from house to house.

How Radon Enters NEPA Homes

Understanding radon entry points helps reveal why a radon inspection is essential. Radon typically infiltrates through:

- Foundation cracks

- Hollow block walls

- Sump pits

- Floor-wall joints

- Gaps around plumbing

- Crawl space vents

- Basement drains

Radon takes the path of least resistance, which is why your basement acts as a vacuum that pulls it inside.

Why Radon Testing Is Essential in NEPA

Pennsylvania law does not require radon testing in homes, but the Department of Environmental Protection strongly recommends it, especially in NEPA.

Radon is the second leading cause of lung cancer in the United States, responsible for more than 21,000 deaths each year, and NEPA consistently records some of the highest radon levels in the country. Many homes exceed the EPA’s 4.0 pCi/L action level, and it’s not uncommon for properties in the region to measure 20, 50, or even 100+ pCi/L.

Radon levels also fluctuate over time, changing with the seasons, home renovations, HVAC adjustments, and foundation settling. The only way to know your home’s current risk is through testing.

Radon testing is simple and affordable, though we do recommend hiring a professional for a short-term or long-term test. DIY kits may not accurately capture the true amount of radon that your family is exposed to.

Regular testing ensures you catch elevated levels early and protects your family’s long-term health.

Tips to Protect Your NEPA Home From Radon

While long-term radon exposure poses serious health risks, homeowners have effective ways to lower indoor levels.

The most reliable solution is a radon mitigation system, commonly known as a sub-slab depressurization system, which pulls radon gas from beneath the foundation and vents it safely outside. When professionally installed, these systems can reduce radon levels by as much as 99%, even in high-risk areas.

Additional improvements can support or enhance mitigation efforts. Sealing major cracks in the foundation reduces unnecessary entry points, and installing airtight covers on sump pits helps block soil gases from entering the basement.

Increasing ventilation—especially in basements and lower levels—can dilute radon concentrations, while encapsulating crawl spaces creates a physical barrier between living spaces and exposed soil, one of the most common radon pathways in older NEPA homes.

Together, these strategies create a comprehensive line of defense, allowing homeowners to bring radon levels down to safe, EPA-recommended thresholds.

FAQs

Are radon levels really higher in NEPA than other regions?

Yes. Northeast Pennsylvania consistently records some of the highest radon readings in the U.S. due to its geology and mining history.

Do only older homes have radon?

No. New homes—especially energy-efficient ones—can have even higher radon levels because they trap indoor air more tightly.

Is radon testing required when buying a home in Pennsylvania?

Not by state law, but many lenders and inspectors strongly recommend it.

Can radon vary between neighbors?

Absolutely. Two homes side by side can have dramatically different levels.

Is radon dangerous at low levels?

Any exposure carries risk, but the EPA recommends mitigation at 4.0 pCi/L or higher.

What Is an Environmental Phase 1 Assessment in PA? Do I Need One?

Buying commercial property in Pennsylvania can be a massive investment, loaded with risks and liabilities that may not appear on a traditional commercial inspection report.

Depending on the property’s previous use, contamination in the ground may be present from old fuel tanks, manufacturing waste, buried debris, or from neighboring properties. Many properties across Northeast Pennsylvania also sit on top of defunct coal mines, wetlands, and natural gas reserves that could be laden with additional red tape that could impact your business’s ability to get off the ground.

A Phase I Environmental Site Assessment (Phase I ESA) is a tool designed to identify potential environmental issues before you purchase or develop land, protecting you from liability and helping lenders evaluate risk. In a state with centuries of industrial activity and widespread legacy contamination, a Phase I ESA can save you from costly cleanup and liability that could stall your business venture.

This guide explains what a Phase I ESA is, why it matters in Pennsylvania, what it includes, and how to determine whether you need one for your next project.

What Is a Phase I Environmental Site Assessment?

A Phase I Environmental Site Assessment is a research-based investigation that evaluates whether contamination may be present on or around a property. It is performed according to the ASTM E1527-21 standard and is considered the national benchmark for environmental due diligence.

How a Phase I ESA Works

A qualified environmental professional researches property records, historical land use, governmental databases, and surrounding land activities, then performs an on-site inspection and interviews knowledgeable parties. The assessment identifies Recognized Environmental Conditions (RECs): indicators that contamination may exist.

Why It Matters

Phase I ESAs protect buyers under the CERCLA “innocent landowner” defense, help lenders minimize risk, and ensure developers understand liabilities before investing. Without a Phase I, you may unknowingly inherit the responsibility for costly remediation.

Why Phase I Assessments Are Important for Commercial Property Owners in Pennsylvania

Northeastern Pennsylvania has a uniquely complex environmental history shaped by more than a century of coal mining, heavy industry, and unregulated waste disposal.

Anthracite mining left behind abandoned mine lands, subsidence zones, coal waste piles, and acid mine drainage that continues to influence groundwater movement today. Many commercial corridors, from Scranton and Wilkes-Barre to Pittston, Hazleton, and the Wyoming Valley, were also built over old rail lines, fuel depots, machine shops, and manufacturing plants that operated long before environmental laws existed.

Even rural NEPA properties, including former farms across Bradford, Wayne, Susquehanna, and Luzerne counties, may contain residual pesticides, buried debris, or undocumented underground storage tanks.

These historic activities mean that contamination may exist even when a site looks clean at the surface. Pollution can migrate through soils and groundwater, move between properties, or remain buried beneath concrete slabs for decades. Because many hazards in NEPA are invisible, commercial buyers cannot rely on visual inspection alone.

A Phase I ESA is the only reliable way to identify environmental red flags early, protect yourself from liability, and avoid inheriting costly cleanup obligations after closing.

Do You Need a Phase I ESA in Pennsylvania?

A phase 1 site assessment is generally beneficial for any commercial property transaction. The following scenarios are most common when buyers or sellers request a Phase 1 assessment.

- Purchasing commercial, industrial, multifamily, or mixed-use property

- Developing land that disturbs soil or changes site use

- Applying for a commercial loan or refinancing

- Redeveloping brownfields or former industrial areas

- Purchasing agricultural land, especially if old tanks or pesticide storage are suspected

Lenders and investors rely on Phase I ESAs to quantify environmental risk. Without one, they may deny financing or require costly additional protections.

Even if you’re a cash buyer, skipping a Phase I means you accept full liability for any existing environmental issues, even those caused by previous owners.

What Is Included in a Phase 1 ESA

A Phase I ESA is structured into four major components. Each step serves a specific purpose and together forms a legally defensible risk assessment.

1. Records Review

The environmental professional searches decades of documentation to understand past and current land use.

Some common sources they will examine include:

- Historical aerial photographs (often from Penn Pilot and USGS archives)

- Sanborn fire insurance maps

- Pennsylvania DEP databases

- EPA databases (CERCLA, RCRA, Brownfields, etc.)

- Underground storage tank registries

- Local zoning, permits, and building records

This step often reveals risks not visible on-site, such as former gas stations, dry cleaners, industrial activity, waste disposal, or nearby spills. In PA, many of these records stretch back 100+ years and highlight long-forgotten hazards.

2. On-Site Inspection (Site Reconnaissance)

During the on-site inspection, the environmental assessor walks the property to look for anything that may indicate current or past contamination. This includes signs such as vent pipes or fill ports from old heating oil tanks, stained soils or stressed vegetation, waste storage areas, unusual floor drains or sumps, debris piles, or concerns on neighboring properties that could migrate onto the site.

Even subtle clues—like a capped metal pipe protruding from the ground or vegetation dying in one concentrated area—can signal deeper risks that may require further investigation in a Phase II assessment.

3. Interviews and Local Research

As part of the Phase I process, the environmental assessor speaks with people who know the property best, including current or former owners, facility managers, neighbors, fire officials, and local zoning or building departments.

These conversations help uncover details that may never appear in written records, including past fuel spills, undocumented underground tanks, old industrial uses, or renovations that altered the site.

This human insight is often critical because many environmental issues in older Pennsylvania properties were never formally recorded, yet still pose liability risks for today’s buyers.

4. Written Report and Environmental Findings

A final report will be written and delivered to the interested parties, including factual information related to:

- Recognized Environmental Conditions (RECs)

- Historical RECs

- Controlled RECs

- Environmental red flags

- Recommendations for Phase II sampling (if needed)

This report provides the legal framework for liability protection and is required by most lenders.

Common Environmental Issues Found in Pennsylvania Phase I ESAs

Due to the state’s industrial past, it’s not uncommon to find potential contaminants in residential and commercial areas. Some of the most common issues we tend to see include:

- Old heating oil tanks behind homes and commercial buildings

- Former manufacturing sites with solvent or metal contamination

- Railroad spurs and rights-of-way containing petroleum byproducts

- Dry cleaner contamination (PCE and TCE)

- Mine-related impacts, such as subsidence or contaminated groundwater

- Pesticide residues on former farmland

- Illicit dumping or buried debris

Each of these conditions can trigger a recommendation for Phase II sampling.

What Happens If the Phase I ESA Finds a Problem?

Phase I identifies potential contamination and risks, but does not confirm them.

If RECs or other issues are found, the next step is typically a Phase II ESA, which may involve:

- Soil sampling

- Groundwater sampling

- Vapor intrusion testing

- Tank tightness testing

- Geophysical surveys

If contamination is confirmed, the PA DEP’s Act 2 Land Recycling Program offers liability protections and cleanup pathways.

Benefits of Getting a Phase I ESA Before Purchasing Property

A Phase I Environmental Site Assessment offers several major advantages for commercial buyers in Pennsylvania:

- Protection from CERCLA/Superfund liability

- Cost savings during negotiation

- Greater confidence in redevelopment projects

- Lender and investor approval

- Long-term risk mitigation

- Clear documentation of environmental conditions

These benefits work together to reduce financial exposure and ensure you fully understand the property you’re purchasing.

Most importantly, a Phase I ESA prevents buyers from unknowingly inheriting historical contamination; a mistake that has cost businesses millions in unexpected cleanup, delays, and legal issues.

Completing a Phase I before closing gives you the confidence and legal protection needed to move forward with any commercial property acquisition in Pennsylvania.

FAQs

How long is a Phase I ESA valid in Pennsylvania?

Phase I ESAs are valid for 180 days, with some components valid for up to one year. After that, updates are required.

How much does a Phase I usually cost?

Most Phase I ESAs in Pennsylvania cost $1,600–$6,000, depending on size, history, and location.

Does a Phase I ESA include testing?

No. Testing is only conducted during Phase II if Phase I finds evidence suggesting contamination.

Can a residential buyer request a Phase I?

Yes, especially if the home is near industrial areas, rail lines, farmland, or suspected tank locations.

What is a REC (Recognized Environmental Condition)?

A present or likely presence of contamination that requires further evaluation.

How long does a Phase I take?

Most take 2–4 weeks, depending on record retrieval and site complexity.

Who is qualified to perform a Phase I?

Only an Environmental Professional (EP) meeting EPA/AASHTO standards can legally complete one.

How to Spot Signs of Previous Water Damage in Your NEPA Home

FEMA recently redesignated thousands of properties across Northeast Pennsylvania as lying in a flood plain, forcing several residents to purchase flood insurance.

Major floods like Tropical Storm Lee in 2011 have left their mark on the region, submerging thousands of properties across Luzerne County in dangerous floodwater. However, water damage isn’t always the result of flooding or heavy snowfall, but can come from structural defects or burst pipes.

If left unresolved, continuous water damage can result in mold and mildew, a bulk of which hides beneath the surface and requires special inspection.

For homeowners looking to purchase a home in Northeast Pennsylvania, identifying water damage could be the difference between expensive repairs and mold remediation.

This guide will help you uncover signs of water damage yourself, as well as tools and services available to inspect for water damage and mold.

Why Water Damage Is Such a Serious Issue

Water intrusion can start small in the form of basement or roof leaks and slowly damage the structure of the house until major repairs are required.

According to Angi, the average cost of repairing water damage is between $3 and $7.50 per square foot, meaning that small leaks caught early can be manageable, but whole-home issues could total over ten thousand dollars easily.

The extent of water damage is often more than meets the eye. Many homeowners may cover over previous water damage on walls and ceilings with new paint, concealing the true depth of the damage, which will be missed without a proper home inspection. Considering that a majority of homes in the region are wood-framed, water exposure to framing components and drywall can rot your home from the inside out very quickly.

Finally, as we’ll discuss below, uncovering water damage can make it difficult for homeowners to insure or acquire a mortgage. Therefore, it’s important to be proactive and spot the signs of water damage before they become unmanageable.

The Three Main Types of Water Damage

An important component of visually inspecting water damage is understanding what type of damage you are dealing with. Water damage can be classified by its source and contamination level, which directly affects cleanup procedures, health risks, and repair costs.

- Clean water damage typically comes from a controlled source—like a burst supply line, leaky faucet, or overflowing sink. While clean water seems harmless, it can soak into porous materials and cause warping or mold growth within 24 to 48 hours if not dried properly.

- Gray water damage comes from appliances such as washing machines or dishwashers. It contains mild contaminants like detergents or food residue, which can create unpleasant odors and encourage bacterial growth. If absorbed into carpets or drywall, gray water damage often requires partial replacement rather than simple drying.

- Black water damage is the most dangerous, originating from sewage backups, river flooding, or storm runoff. Black water carries bacteria, waste, and chemicals that can pose serious health risks and almost always demand professional cleanup and disinfection.

Knowing what kind of water caused the problem helps inspectors determine both how extensive the damage is and why certain repairs are necessary to prevent recurrence.

How to Spot Visible Signs of Previous Water Damage

Not all signs of water damage are obvious at first glance. Many homeowners unknowingly live with the remnants of past leaks or flooding because they’ve been cosmetically covered up. Here’s how to identify the most common clues.

- Stained or discolored walls and ceilings. Yellow, brown, or rust-colored rings on drywall or plaster suggest that water once seeped behind the surface. Even if painted over, these stains often bleed back through over time.

- Peeling or bubbling paint. Moisture is trapped beneath the surface. As water vapor pushes outward, it causes the paint to lose adhesion, blister, or flake. This often happens near bathrooms, basements, or exterior walls that weren’t properly sealed.

- Warped or buckled flooring. Hardwood planks that cup or laminate panels that swell at the edges are telltale signs of a past leak or high humidity. In flood-prone parts of Pennsylvania, basement flooring often hides this damage under rugs or vinyl overlays.

- Musty odors. If you notice a damp or earthy smell in a finished basement, crawl space, or under a sink, it’s often a sign of mold or residual moisture trapped inside materials.

- Mold or mildew growth. Appears as black, green, or white spots along baseboards, corners, or behind furniture. Mold doesn’t appear unless there’s been sustained moisture, so its presence almost always points to prior water intrusion.

- Sagging ceilings or softened drywall. These structural changes occur when materials lose rigidity after prolonged exposure, often from roof leaks or pipe bursts hidden in upper floors.

If you spot any signs of current or previous water damage, contact a professional home inspector right away to determine the extent of the damage.

How Home Inspectors Spot Hidden or Structural Water Damage

Professional home inspectors use specialized tools and techniques to detect water damage that isn’t visible to the naked eye.

Inspectors often begin with moisture meters to measure the exact moisture content within walls, ceilings, and floors. By comparing readings across different sections of the home, they can determine where water was absorbed and how far it spread.

They also use infrared (thermal) cameras to locate cold spots that indicate trapped moisture. Water cools more slowly than dry materials, so these cameras can reveal leaks behind walls, under insulation, or around window frames—areas that may look fine on the surface.

Inspectors will check attics and crawl spaces for subtle indicators such as rusted nails, water-stained insulation, or discolored sheathing. These spaces often reveal roof leaks or poor ventilation that can lead to long-term dampness.

Finally, they will inspect plumbing systems and foundation areas, looking for mineral deposits, corrosion, or efflorescence—a white powdery substance that forms when moisture seeps through masonry. These signs tell inspectors how water traveled through the home and why certain repairs may be needed to stop future leaks.

Because water can move in unpredictable ways, professional inspections are often the only way to uncover the full extent of damage after storms or floods.

Does Previous Water Damage Affect Home Insurance?

Water damage can impact your home insurance, but the impact depends on how and why the damage occurred. Insurance companies distinguish between sudden events, like burst pipes, and gradual problems, such as long-term seepage. Sudden damage is typically covered, while gradual damage is often excluded.

Homes in designated flood zones, such as along the Susquehanna or Lackawanna Rivers, may also require separate flood insurance. Standard homeowners’ policies do not cover flood-related damage, which is why documentation from professional inspections can make a big difference when applying for coverage or filing claims.

Insurers may raise premiums or limit coverage if a home has a history of multiple water claims. Having a clear inspection report that shows how and when damage was repaired helps protect your eligibility and ensures transparency during property sales.

How to Protect Your Home from Future Water Damage

Preventing future water damage in Pennsylvania starts with understanding how local weather and terrain affect your property. Here’s how to reduce the risk of future water damage:

- Inspect your roof and gutters twice a year. Clean debris and check for damaged shingles before snow or heavy rain arrives.

- Seal foundation cracks. Use waterproof epoxy or sealant to prevent groundwater from seeping through basement walls.

- Install or maintain a sump pump. Test it before storm season to ensure it can handle runoff and snowmelt.

- Improve drainage around your property. Extend downspouts at least five feet away from your foundation to keep water moving downhill.

- Maintain proper indoor humidity. Use dehumidifiers in basements or crawl spaces to keep moisture below 50%.

- Schedule annual inspections. Professional home inspections catch minor leaks, roof wear, or ventilation problems before they turn into costly repairs.

Taking these steps helps protect your home against the same threats that cause widespread damage across Northeast Pennsylvania each year.

FAQs

What areas in Northeast Pennsylvania are most prone to flooding?

Low-lying regions along the Susquehanna River, such as Kingston, Forty Fort, and West Pittston, are in high-risk flood zones. Parts of Stroudsburg, Scranton, and Wilkes-Barre have also experienced repeated basement flooding due to poor drainage and old stormwater systems.

How can I tell if a home in a flood zone has been damaged before?

Look for water lines on basement walls, rusted support beams, or signs of fresh paint that may cover old stains. A professional inspector can verify whether the damage is recent or historical using moisture and infrared tools.

Are homes with previous water damage harder to insure in Pennsylvania?

Yes. If a property has a record of frequent water claims, insurers may increase rates or require additional inspections. A clean, documented inspection report helps maintain eligibility.

How often should I schedule a home inspection for water damage?

Annually is best, especially after major storms or rapid snowmelt. Regular inspections help identify early warning signs before they develop into major repairs.

How Snow and Ice Can Damage Your NEPA Roof (and How to Spot It)

Scranton, Pennsylvania, averages around 41” of snowfall annually, putting it over 10” above the national average.

Much of that snow will stick to your roof all winter long, placing heavy pressure on your roof and eroding asphalt shingles, which can lead to structural damage.

However, the real danger of snowfall comes from ice dams, which form on the perimeter of your roof as snow melts and freezes. Most modern roofs are now built with ice and water barriers, but if your roof is old or outdated, it may not have proper protection.

Ice can also freeze standing water in gutters, forcing melting snow to accumulate around your foundation.

This guide will discuss several winter threats to roofs in Northeast Pennsylvania and ways to winterize your roof for Pennsylvania’s frigid winters.

How Winter Weather Puts Roofs at Risk

Your roof is built to withstand a lot in order to protect your home, but older or poorly installed roofs may suffer from eroded shingles, ice dams, or leaks that put your home and attic at risk. During the winter, a combination of moisture, freezing temperatures, and the weight of snow and ice can push roofing materials and structures past their limits.

Here are a few of the key culprits to watch out for this winter:

- Snow accumulation: Even light, fluffy snow adds up in weight. Wet, heavy snow can weigh up to 20 pounds per cubic foot, creating thousands of pounds of stress on your roof.

- Ice formation: When snow melts and refreezes, it forms thick layers of ice that trap moisture and block proper drainage.

- Freeze-thaw cycles: Repeated melting and freezing cause roofing materials to expand and contract, weakening seals and loosening shingles.

Together, these forces can cause a chain reaction of roof damage that starts small but worsens rapidly with every storm.

Top 6 Winter Threats to Roofs in Pennsylvania

1. Ice Dams

Ice dams form when warm air from your attic melts the underside of the snow on your roof. As meltwater runs down to the roof edge, where it’s colder, it refreezes, creating a ridge of ice.

Once that ice dam forms, new meltwater can’t drain off properly, causing the water to pool behind the dam and seep under shingles and flashing, leaking into your attic or walls.

Many homeowners are largely unaware of ice dams and may ignore obvious signs, such as icicles hanging from the edges of their roof.

Signs of Ice Dam Damage

-

- Water stains or bubbling paint on ceilings and walls

- Icicles hanging from eaves or gutters

- Mold growth in the attic or insulation

- Damp or compressed attic insulation

- Water stains or bubbling paint on ceilings and walls

How to Prevent Ice Dams

-

- Improve attic insulation and ventilation: Proper airflow keeps your roof’s surface cold and prevents uneven melting.

- Seal attic leaks: Warm air escaping from vents, chimneys, or light fixtures contributes to snow melt.

- Use a roof rake: Gently remove snow buildup near the edges after major storms (without climbing onto the roof).

- Consider heat cables: Electric de-icing cables can help melt ice along the eaves in problem areas.

- Improve attic insulation and ventilation: Proper airflow keeps your roof’s surface cold and prevents uneven melting.

2. Structural Stress from Heavy Snow

A little snow looks harmless, but when accumulation builds up, your roof can experience extreme weight loads. This is especially risky for older homes, flat or low-pitched roofs, or structures with aging support beams or damaged sheathing.

Wet snow can be particularly heavy. For example:

- 10 inches of fresh snow = roughly 5 pounds per square foot

- 10 inches of wet snow = up to 20 pounds per square foot

If several storms pile on before melting, that weight can cause sagging, cracking, or even collapse.

Signs of Snow Load Damage

-

- Sagging rooflines or ceilings

- Cracking or popping sounds in the attic

- Doors and windows that suddenly stick or misalign

- Leaks around roof penetrations (vents, chimneys, skylights)

- Sagging rooflines or ceilings

How to Relieve Accumulated Snow Pressure

-

- Use a roof rake from the ground to remove excess snow.

- Hire a professional for deep or compacted snow removal—never climb onto a snow-covered roof.

- If you notice sagging or cracking, call a roofing or structural expert immediately.

- Use a roof rake from the ground to remove excess snow.

3. Shingle and Flashing Damage

The constant freezing and thawing of winter can be brutal on asphalt shingles and metal flashing. As water seeps into small cracks or under lifted shingles, it freezes, expands, and causes further separation. Over time, this leads to broken seals, curling shingles, and corrosion.

Signs of Shingle or Flashing Damage

-

- Missing, cracked, or curled shingles

- Exposed nail heads or flashing that’s lifting

- Dark streaks or granule loss on shingles

- Water stains around chimneys, skylights, or vents

- Missing, cracked, or curled shingles

Maintenance Tips for Shingles and Flashing

-

- Inspect your roof before and after winter storms.

- Keep gutters and downspouts clear so meltwater can drain properly.

- Replace damaged shingles or flashing promptly to prevent leaks.

- Inspect your roof before and after winter storms.

4. Gutter and Downspout Issues

Gutters play a vital role in directing meltwater away from your roof and foundation, but when they’re clogged or frozen, it can allow water to accumulate around your foundation.

Additionally, ice accumulation in gutters can cause them to pull away from the roofline, damage fascia boards, and create dangerous icicles. When meltwater has nowhere to go, it can also back up under shingles and into your home.

Signs of Gutter Trouble

-

- Ice hanging off the roof edges

- Water dripping down siding even when it’s not raining

- Detached or sagging gutters

- Pooling water around the foundation

- Ice hanging off the roof edges

How to Maintain Gutters During Winter

-

- Clean gutters thoroughly before winter.

- Make sure downspouts extend several feet away from your home.

- Add gutter guards or heating cables if ice buildup is a recurring issue.

- Clean gutters thoroughly before winter.

5. Hidden Water Intrusion and Mold Growth

Not all winter roof damage is visible right away. Water that seeps through the roof deck or insulation can take weeks—or even months—to show up as visible staining or mold.

Over time, trapped moisture weakens your attic structure, reduces insulation performance, and fosters unhealthy air conditions.

How to Spot Hidden Moisture Damage

-

- A musty odor in the attic or upper floors

- Peeling paint or bubbling drywall

- Damp insulation or visible mold patches

- A sudden increase in heating bills (a sign that insulation has been compromised)

- A musty odor in the attic or upper floors

If you suspect moisture damage, it’s best to have a professional roof or insulation inspection. Thermal imaging can also help identify hidden wet spots before they spread.

6. Freeze-Thaw Damage on Flat Roofs

Homes and commercial buildings with flat or low-slope roofs face unique winter challenges, as meltwater tends to pool instead of draining, allowing it to refreeze overnight and damage membrane seams.

How to Identify Flat Roof Damage

-

- Ponding water that lasts more than 48 hours after melting

- Cracked seams or bubbles in the roofing membrane

- Leaks appearing around vents or rooftop equipment

- Ponding water that lasts more than 48 hours after melting

Keeping drains and scuppers clear is key. Professional maintenance before and after the season can save thousands in repair costs.

How to Inspect Your Roof After Winter

The best way to prevent winter roof damage is to conduct an inspection before and after the winter season.

Perform a visual inspection in the fall, winter, and spring to spot potential issues as they manifest on your roof, looking for:

- Uneven snow melt (which can indicate poor insulation or ventilation)

- Missing shingles, sagging areas, or exposed wood

- Gutters containing icicles, ice dams, or debris buildup

- (Attic) Damp insulation, mold, or daylight that can be spotted through the roof boards

If you spot any warning signs, schedule a professional roof inspection. A home inspector can safely assess hidden damage and recommend targeted repairs before leaks and rot take hold.

Protecting Your Roof Year-Round

Winter roof damage is often preventable with the right preparation and maintenance. Here’s how to stay ahead this winter:

- Schedule a pre-winter roof inspection: A professional can identify weak spots before the first snow falls.

- Add insulation and ventilation: A balanced attic temperature prevents ice dams and reduces energy costs.

- Clean gutters and downspouts regularly: Proper drainage is your roof’s first line of defense.

- Trim overhanging branches: Snow-laden limbs can break and damage shingles or gutters.

- Address small repairs immediately: A minor leak in December can become major water damage by March.

By keeping on top of basic maintenance and performing a visual inspection of your roof each season, you can spot issues before they compound. When issues do pop up, be sure to contact a professional inspector immediately to determine the next steps.

FAQs

How can I tell if ice dams are forming on my roof?

Look for large icicles hanging from the eaves, water stains on your ceiling or walls, and uneven snow melt across the roof. These are all common signs of ice dam formation.

Is it safe to remove snow from my roof myself?

You should never climb onto a snow-covered roof. Use a roof rake from the ground to remove excess snow, or hire a professional if buildup is heavy or difficult to reach.

How much snow is too much for a roof to handle?

Most roofs can support about 20 pounds of snow per square foot. Wet, compacted snow weighs much more than fresh powder—if your roof starts to sag or creak, call a roofing expert immediately.

Common Roof Problems and How to Spot Them

The average cost of a roof replacement in the United States is around $9500, but in some cases it can climb past $50,000 because materials, labor, and structural repairs vary widely.

That’s why spotting common roofing problems early is one of the most effective ways homeowners can avoid catastrophic expenses.

Roofs are a structural shield for your home because they prevent water, wind, and snow from penetrating the interior. This is why real estate buyers in Northeast Pennsylvania place a premium on newer roofs—any roof built within the past five years adds value because it lowers the risk of immediate replacement costs.

When a roof ages or suffers damage, the problems go far beyond appearance. Loose shingles, popped nails, or failed flashing are how water seeps into the attic, and once that happens, mold and rot can double or triple repair costs.

Aging or damaged roofs are more than an eyesore. They can invite leaks and damage your attic, potentially doubling the cost of your repairs.

If you’re uncertain about a roof’s age or condition, a professional home inspection reveals defects you can’t see from the ground and estimates the timeline for future repairs. Inspections matter because many Pennsylvania homes are decades old, and harsh seasonal weather accelerates wear.

Homeowners can also catch visible warning signs on their own. From the road, sagging lines or dark streaks are how you can spot deterioration, while a closer look from a ladder may show curling shingles or corroded flashing.

Recognizing these issues early is why buyers, sellers, and current homeowners can save thousands by taking corrective action before small problems escalate.

This guide explains the most common roofing problems in Pennsylvania homes and shows you exactly how to spot them before they turn into costly repairs.

8 Common Roof Problems in Pennsylvania

1. Aging or Damaged Shingles

Most Pennsylvania homes use asphalt shingles, typically lasting 20–30 years. Over time, shingles can crack, curl, or go missing entirely. You might also notice granule loss, where small sand-like particles wash into your gutters.

Be on the lookout for shingles that are curling upward, discolored, or missing after storms. If you see bald spots where granules have worn away, it’s a sign the roof may be near the end of its life.

2. Ice Dams and Water Intrusion

Winters in Pennsylvania bring heavy snow and freezing temperatures. When warm air from the attic melts snow on the roof, water can refreeze at the edges, forming an ice dam. This prevents proper drainage, causing water to back up under shingles.

You’ll notice water stains forming on interior ceilings or walls, especially near exterior walls. Outside, you’ll also be able to spot thick icicles forming along gutters in the winter.

3. Popped Nails

Roofing nails can loosen over time due to expansion and contraction from temperature changes. When they pop up, they create tiny gaps that let in water and increase the risk of leaks.

You’ll need to inspect your shingles closely to identify any popped or lifting nails. Take proper precautions, such as wearing proper traction shoes and securing your ladder before climbing onto your roof.

4. Flashing Failures

Flashing is the thin metal material installed around chimneys, skylights, and roof valleys to prevent leaks. Over time, flashing can rust, crack, or pull away from the roof surface.

Check the base of your chimney or skylights for signs of rust, gaps, or deteriorated sealant. Inside, leaks in these areas often show up as ceiling stains near fireplaces or in upstairs bathrooms.

5. Gutter and Drainage Problems

Gutters play a huge role in directing water away from the home. Rain and snow are frequent occurrences in wet and forested regions like NEPA, but your gutters can quickly get clogged with debris from leaves and trees.

During rainfall, check if water is overflowing the gutters or pooling near your foundation. After storms, look for detached or sagging gutter sections.

6. Chimney and Masonry Issues

Pennsylvania has many older homes with brick chimneys. Over time, mortar joints can crack and bricks can deteriorate, allowing water to seep into the roof system.

Start from the ground and check if the chimney looks cracked, leaning, or missing mortar. A roof inspector may also point out spalling bricks (flaking surfaces) that indicate water damage.

7. Moss, Algae, and Lichen Growth

Pennsylvania’s damp climate makes roofs susceptible to moss and algae growth, particularly on shaded sides of the house. While it may look cosmetic, moss can trap moisture and cause shingles to deteriorate faster.

8. Structural Sagging

Roofs with long-term water damage or poor installation can begin to sag, which poses a serious structural risk. Older farmhouses and century homes in Pennsylvania are particularly vulnerable if the framing wasn’t updated during renovations.

In extreme cases, you’ll notice the roof bowing or sagging, indicating significant structural stress.

Tips to Spot Problems Before They Get Worse

Like many things in life, early detection is key to fixing issues before they compound.